RuPaul Charles is probably feeling a little fortunate that he gets to stay out of the public eye this week. The beloved host of reality competition series RuPaul’s Drag Race is facing some controversy from a small segment of his fanbase after the casual revelation that he leases some of his Wyoming land to energy companies.

Continue readingAuthor Archive: admin

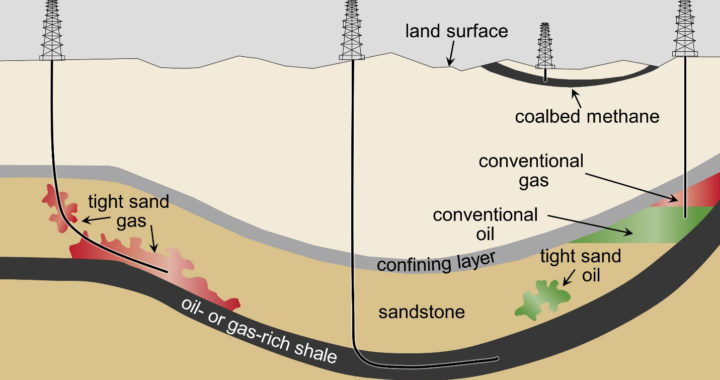

What’s the Difference Between Shale, Crude Oil, and Natural Gas?

Over the last ten days, the United States’ chief energy competitors Russia and Saudi Arabia, launched a two-pronged assault designed to destabilize the thriving US oil and gas industry. Russia is attempting to flood the market with shale oil and natural gas. Saudi Arabia is pumping out cheap crude. And the United States, awash in all of them, is preparing a strategy to stay out in front.

Continue readingColorado Advocates Pushing for More Renewable Natural Gas

It seems that, in 2020, the entire nation has finally gotten down to the business of fighting climate change. Climate activists, legislators, and oil and gas industry professionals are all tackling climate change with their own ideas. More often than not, those efforts are focused on increasing the range of solar and wind power as well as finding more efficient ways to extract oil and gas.

Continue readingOil and Gas Execs Want to Set the Record Straight

In the days leading up to Super Tuesday, the majority of the Democratic field can only agree on one issue. Time and time again, the likes of Elizabeth Warren and Bernie Sanders have scored easy political points by decrying the oil and gas industry’s role in climate change. Perhaps no other issue facing the United States today is as volatile or as misunderstood as the debate raging around oil and gas extraction.

Continue readingDepartment of Interior Exceeds 1 Billion Barrels on Public Lands

The United States Department of Interior reports that during fiscal year 2019, the US produced one billion barrels of oil on federal public lands for the first time in history.

Continue reading