At noon on Friday, the last day of the work week, Baker Hughes will continue a tradition began in 1944 when they release their weekly US rig count. Week after week, month after month, year after year, this metric is used by journalists, financial experts, and academics as the pulse of the domestic oil and gas industry.

But what does the Baker Hughes rig count truly measure, and what do its rise and fall mean for the industry at large?

The Baker Hughes Rotary Rig Count

For 75 years, Baker Hughes, an oilfield products and services company owned by GE, has published a weekly count of the nation’s active rotary rigs.

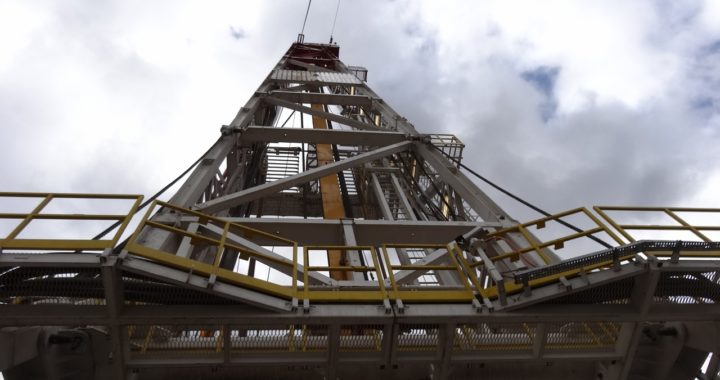

A rotary rig is the bit of machinery that “rotates the drill pipe from [the surface] to drill a new well (or sidetracking an existing one) to explore for, develop and produce oil or natural gas.” Hughes doesn’t take into account rigs with low production in this number, but the company will include specific non-rotary rigs in the US rig count under certain circumstances.

In other words, Baker Hughes believes the active rig count to be an accurate measurement of the future demand for oilfield products and services. In a very real sense, the US rig count is used by Baker Hughes to indicate how profitable their company (and other oilfield services companies) may be in the future.

Academics also use Baker Hughes’ count as a means to study long-term fluctuations in the industry.

How Important Is the Rig Count, Really?

In today’s oil and gas sector it would be easy to make the mistake of discounting the importance of the US rig count. Advancements in technology and improvements in the efficiency of extraction, for example, have created an industry that can flourish even when rig counts fall. As such, it has become impossible to judge the overall health of the domestic oil and gas industry using the Baker Hughes rig count alone.

In spite of the changes to the oil and gas industry, the US rig count remains a vital measurement, because it measures physical investment. Unlike other metrics which measure potential, the Baker Hughes count represents the genuine faith that investors have in oil and gas.